About Options

Options Technology (Options) is a financial technology company at the forefront of banking and trading infrastructure. We serve clients globally with offices in New York, London, Belfast, Cambridge, Chicago, Hong Kong, Tokyo, Singapore, Paris, and Auckland. At Options, our services are woven into the hottest trends in global technology, including high-performance Networking, Cloud, Security, and AI (Artificial Intelligence).

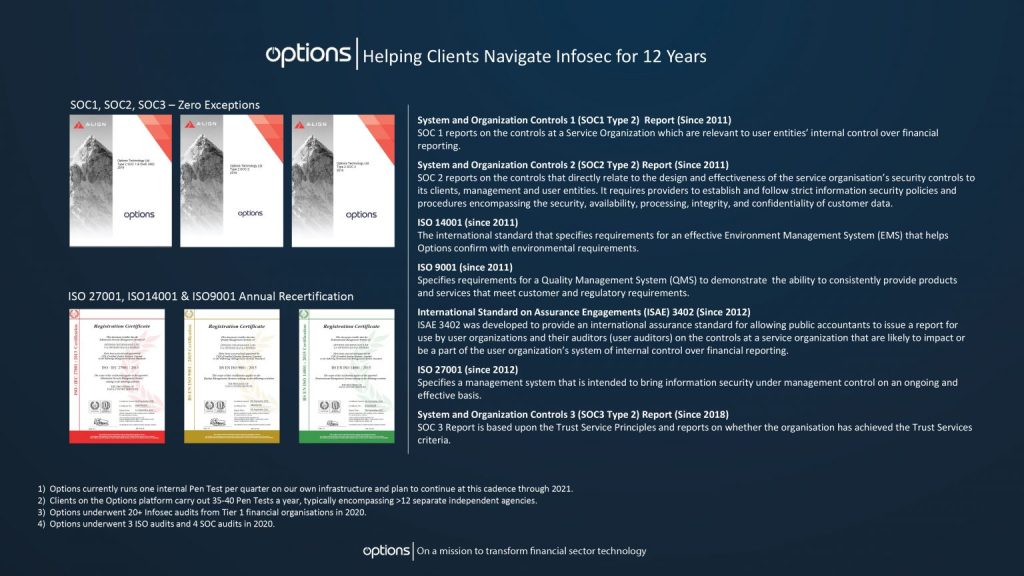

At Options we believe that our commitment to delivering World Class (or as we call it “Investment Bank Grade”) Cybersecurity and Compliance services is the cornerstone of our ability to serve clients.

We have unique pedigree amongst our peers on the security front. We’ve underwent and passed annual key InfoSec audits run by security teams in the top five global banks consistently since 2011, giving ten years under our belts operating at the highest level. Through the period we’ve also invested in gaining and retaining key SOC and ISO accreditations etc, as these evolve year on year.

We also believe that our ability to support clients in meeting their internal requirements is just (or almost) as important as keeping the infrastructure secure. Cybersecurity standards have increasingly became a hurdle to do business, be these security, risk, governance, compliance or even vendor and investor due diligence, so over the next few years we believe that any firm that seeks to operate in Alternative investment or Capital Markets will be held to ever increasing standards.

Our mission is to continually evolve our solutions to give our clients a competitive edge by meeting the exacting needs of investors, auditors and regulators worldwide.